WASHINGTON (AP) – Federal regulators have filed civil fraud charges against former NFL cornerback Will Allen and his business partner. They’re accused of reaping more than $31 million in a Ponzi scheme that promised high returns to investors from funding loans to cash-strapped pro athletes.

The Securities and Exchange Commission announced the charges Monday against William D. Allen, Susan Daub and their Capital Financial Partners investment firms.

The SEC said Allen and Daub paid about $20 million to investors but received only around $13 million in loan repayments from athletes. To make up the gap they paid investors with other investors’ money rather than actual profits on the investments, in a classic Ponzi scheme, the agency said.

The telephone wasn’t answered at a listing for Will D. Allen in Davie, Fla., where Allen is said to live. A person answering the phone at Daub’s home said there was no comment. They are not represented in the case by attorneys, according to the SEC.

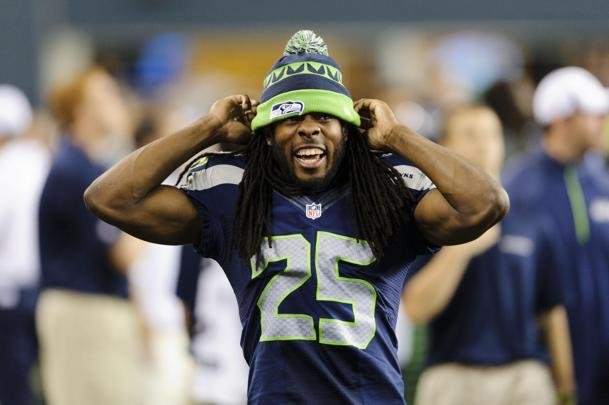

Allen, 36, was a cornerback in the NFL from 2001 to 2012, playing for the New York Giants and the Miami Dolphins. He was signed by the New England Patriots in March 2012 but was placed on injured reserve the following August, and he left football in March 2013.

Daub, 54, is a financial professional who also lives in Florida, according to the SEC.

The SEC said Allen and Daub misled investors about the terms and even the existence of some of the loans, telling them they could receive interest on the loans of up to 18 percent from the athletes. The pair used some funds from investors to cover personal charges at casinos and nightclubs and to finance other business ventures, the agency alleged.

The SEC said its lawsuit against Allen and Daub was filed under seal in federal court in Boston last week and unsealed on Sunday. The agency won an asset freeze against them from the court last week. Two of their firms are based in Boston.

The SEC is seeking an injunction against Allen and Daub and the firms, as well as unspecified penalties and restitution of allegedly ill-gotten gains.

”As in any Ponzi scheme, the appearance of a successful investment was only an illusion sustained by lies,” Paul Levenson, director of the SEC’s regional office in Boston, said in a statement.

25% Bonus via Western Union